Most US stocks rise, but Nvidia’s drop keeps the market in check

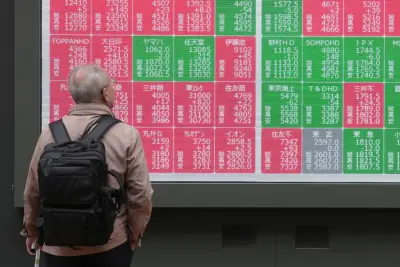

NEW YORK AP Majority U S stocks are rising Tuesday following updates on the business sector that kept alive hopes for a coming cut to interest rates The S P rose as five out of every six stocks within the index climbed The Dow Jones Industrial Average was up points or as of a m Eastern time and the Nasdaq composite was lower The relatively modest moves for indexes masked several swings underneath the surface particularly among stocks linked to the artificial-intelligence industry Alphabet rose another continuing a strong run on excitement about its in recent times circulated Gemini AI model Chinese giant Alibaba meanwhile saw its stock that trades in the United States fall after losing an early gain It informed stronger revenue than analysts expected for the latest quarter thanks in part to the AI boom but its overall profit fell short of forecasts Selected chip companies dropped sharply following a description from the Information that Meta Platforms is in talks to spend billions of dollars on AI chips from Alphabet instead of them Nvidia sank and was the heaviest weight on the S P while Advanced Micro Devices dropped Mixed profit reports also caused big swings for several retailers Abercrombie Fitch soared after the apparel seller informed a stronger profit for the latest quarter than analysts expected It also raised the bottom end of its forecast for revenue and profit over the full year Koh s surged after reporting a profit for the latest quarter when analysts were expecting a loss Best Buy rose after boosting its profit forecast for the full year following a better-than-expected third quarter citing strength across computing gaming and mobile phones They helped work against a drop for Dick s Sporting Goods which disclosed a weaker profit than expected Executive Chairman Ed Stack mentioned the company is cleaning out the garage by clearing inventory at Foot Locker which it in recent weeks bought Helping to keep the overall field calm were hopes that the Federal Reserve will cut its main interest rate at its next meeting in December The Fed has already cut rates twice this year in hopes of shoring up a slowing financial system and lower interest rates can cover up a lot of sins in financial markets including prices going too high A raft of economic input on Tuesday left traders betting on a nearly probability that the Fed will cut in December according to statistics from CME Group That s roughly the same as a day before and up sharply from the coin flip s chance seen a week ago One assessment stated that shoppers bought less at U S retailers in September than economists expected a signal of a anticipated slowdown for the economic system Another announced confidence among U S consumers worsened by more than economists expected in another potentially sign that the business sector could use lower interest rates A third overview meanwhile reported that inflation at the wholesale level was a touch worse in September than economists expected but a closely tracked underlying trend was slightly better That s fundamental because lower interest rates can make inflation worse and still-high inflation is the main deterrent that could push the Fed to hold off on more cuts After taking all the information together several economists suggested the Fed and its chair Jerome Powell could be leaning toward cutting rates on Dec Taking a pause on rate cuts would ostensibly do more damage to sentiment than a cut would help according to Brian Jacobsen chief economist at Annex Wealth Management who also revealed Powell doesn t need to be the Grinch that stole Christmas In the bond field the yield on the -year Treasury eased to from late Monday Easier interest rates can help stocks of smaller companies in particular because of the need for a great number of of them to borrow to grow The Russell index of the smallest U S stocks rose to lead the realm In stock markets abroad indexes rose modestly across much of Europe and Asia AP Business Writer Elaine Kurtenbach contributed Source