Big Tech’s ‘spend little, earn lots’ formula is threatened by AI

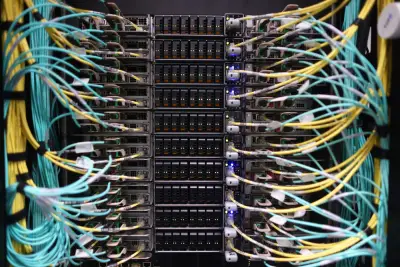

By Jeran Wittenstein Bloomberg For two decades the playbook for Big Tech was fairly simple and extremely fruitful Create disruptive innovations deliver blinding increase rates and keep a lid on spending A handful of behemoths like Alphabet Inc Amazon com Inc Meta Platforms Inc and Microsoft Corp used this formula to seize area share from legacy businesses and power the US stock area to record after record But a key part of the initiative the relatively small amount of capital required to generate those huge profits is increasingly under threat from the race to develop artificial intelligence RELATED Evidence center planned for Bay Area office building site leased by Nvidia Related Articles Viral prison photos of Diddy are AI-generated rep says Apple artificial intelligence head to leave after AI struggles Figures center planned for San Jose office building site leased by Nvidia Nvidia buys billion of chip utility maker Synopsys stock AI country hit Walk My Walk built on Blanco Brown s sound sparks ethical questions They re specific of the best business models the realm has ever seen commented Jim Morrow chief executive officer at Callodine Capital Management which oversees billion in assets Now you ve seen this explosion in capital intensity to the point where it s now the greater part capital intensive sector in the area That s just a radical change Those four companies alone are expected to devote more than billion combined to capital expenditures in their current fiscal years with majority going to chips servers and other records center-related expenses That s a more than jump from a decade ago And they ve all pledged to spend significantly more in the year after that Microsoft s capex is now of its revenue more than three times what it was years ago according to evidence compiled by Bloomberg The utility and cloud-computing giant s spending-to-sales ratio is among the top in the S P as are Alphabet s and Amazon s well above companies in traditionally capital-intensive industries like oil and gas exploration and telecommunications Despite the uncertainty of future payoffs investors are giving the tech giants the benefit of the doubt on their AI plans at least so far Almost all of the big spenders have seen their stock prices rise this year and their valuations are elevated For example Microsoft shares are up in and the stock is priced at more than times profits projected over the next months higher than its -year average of roughly times and the S P s multiple of according to content compiled by Bloomberg But there are creeping signs of doubt Meta which owns Facebook and Instagram was punished after its third-quarter earnings document because Chief Executive Officer Mark Zuckerberg failed to chart a convincing path to bigger profits from rising AI spending The stock had its worst session in three years on Oct plunging the day after Meta shared earnings and it has lost an additional since then After soaring through the first three quarters the shares are now up for the year underperforming the S P One area of debate is rising depreciation expenses from AI chips and servers Michael Burry the hedge fund manager made famous by the book The Big Short suggested that such equipment should be written down on a faster schedule which would seriously dent the companies profit upsurge The spending is also weighing on free cash flow which could limit the expansion of capital returns to shareholders via stock buybacks and dividends Alphabet for example is projected to generate free cash flow of billion this year down from billion last year and billion in Meta and Microsoft are expected to have negative free cash flow after accounting for shareholder returns while Alphabet is seen roughly urgent even according to material compiled by Bloomberg Intelligence At the same time a large number of companies are increasingly turning to debt and off-balance sheet vehicles to fund their spending which raises its own risks Meta for instance of late sold billion of bonds in the largest inhabitants high-grade corporate debt deal of the year and arranged a roughly billion private financing package Lower valuations could be the end of this shift from capital-light to capital-intensive business models according to Michael Bailey director of research at Fulton Breakefield Broenniman A more capital-intensive business will allegedly have more of a boom-bust cycle he noted Investors generally pay less for that With seven machinery companies accounting for about a third of the territory capitalization weighted S P lower multiples would almost certainly weigh heavily on the benchmark All of which highlights the uncharted territory investors are in when it comes to AI spending Never before have the world s biggest and majority effective companies all decided to throw so much cash at a promising but unproven instrument These are companies that historically have not really had to compete with each other They ve all had their own niche in a fairly oligopolistic or monopolistic sort of niche of the sector where they derived huge profits in low capital intensity businesses and now they re all kind of squaring off with different high capital intensity AI business models Callodine s Morrow explained An uncertain outcome at a really high multiple is the threat I think the sector has to grapple with More stories like this are available on bloomberg com Bloomberg L P